USA QuickBOOK Online Bookeeping Job Upwork Unites States

Job highlights

Identified by Google from the original job post

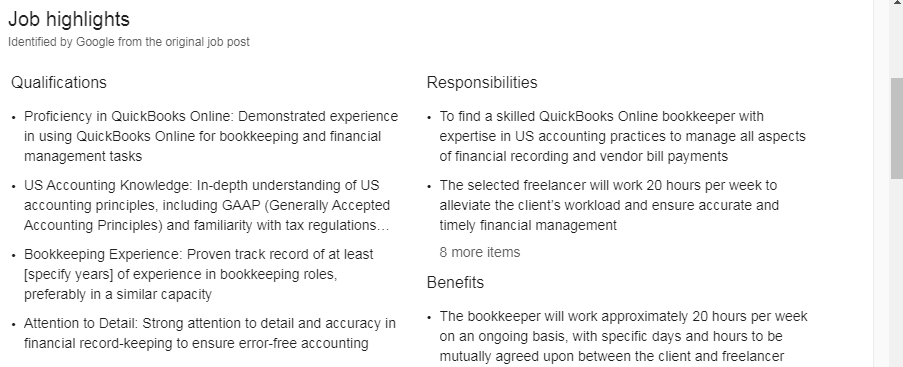

| Qualifications•Proficiency in QuickBooks Online: Demonstrated experience in using QuickBooks Online for bookkeeping and financial management tasks•US Accounting Knowledge: In-depth understanding of US accounting principles, including GAAP (Generally Accepted Accounting Principles) and familiarity with tax regulations and compliance requirements•Bookkeeping Experience: Proven track record of at least [specify years] of experience in bookkeeping roles, preferably in a similar capacity•Attention to Detail: Strong attention to detail and accuracy in financial record-keeping to ensure error-free accounting•Time Management: Ability to effectively manage time and prioritize tasks to meet deadlines in a fast-paced environment•Communication Skills: Excellent written and verbal communication skills to interact with clients, vendors, and team members effectively•Problem-Solving Abilities: Capacity to identify and resolve accounting discrepancies or issues promptly and independently•Reliable Internet Connection: Stable internet connection and access to necessary software and tools for remote work•Any relevant certifications or additional qualifications will be considered advantageous•Confidentiality of all financial information is of utmost importance and must be maintained at all times | Responsibilities•To find a skilled QuickBooks Online bookkeeper with expertise in US accounting practices to manage all aspects of financial recording and vendor bill payments•The selected freelancer will work 20 hours per week to alleviate the client’s workload and ensure accurate and timely financial management•Bookkeeping: Perform day-to-day bookkeeping tasks including recording financial transactions, reconciling bank and credit card accounts, and maintaining accurate records in QuickBooks Online•Vendor Bill Management: Manage the entire vendor bill payment process, including receiving invoices, verifying accuracy, obtaining approvals, and processing payments in a timely manner•Accounts Payable: Maintain accounts payable records, track outstanding balances, and ensure timely payment of bills to vendors while maximizing cash flow efficiency•Financial Reporting: Generate monthly financial reports, including profit and loss statements, balance sheets, and cash flow statements, to provide insights into the company’s financial performance•Budgeting Support: Assist in the preparation and monitoring of budgets, track expenses against budgeted amounts, and provide recommendations for cost-saving measures•Tax Compliance: Ensure compliance with US tax regulations, including timely filing of sales tax returns, 1099 reporting, and providing necessary documentation for annual tax preparation•Communication: Maintain open and clear communication with the client to address any financial concerns, provide updates on bookkeeping tasks, and respond promptly to inquiries•Data Security: Maintain strict confidentiality of financial information and adhere to data security protocols to protect sensitive financial dataBenefits•The bookkeeper will work approximately 20 hours per week on an ongoing basis, with specific days and hours to be mutually agreed upon between the client and freelancer•The budget for this position will be based on the freelancer’s experience, qualifications, and proposed hourly rate |

Job description

Title: Detailed Requirements for Hiring a QuickBooks Online Bookkeeper Objective To find a skilled QuickBooks Bookeeping Job Online bookkeeper with expertise in US accounting practices to manage all aspects of financial recording and vendor bill payments.Bookeeping Job The selected freelancer will work 20 hours per week to alleviate the client’s workload and ensure accurate and timely financial management. Key Responsibilities: Bookkeeping: Perform day-to-day bookkeeping tasks including recording financial transactions, reconciling bank and credit card accounts, and maintaining accurate records in QuickBooks Online. Vendor Bill Management:Bookeeping Job Manage the entire vendor bill payment process, including receiving invoices, verifying accuracy, obtaining approvals, and processing payments in a timely manner. Accounts Payable: Bookeeping Job Maintain accounts payable records, track outstanding balances, and ensure timely payment of bills to vendors while maximizing cash flow efficiency. Financial Reporting:Bookeeping Job Generate monthly financial reports, including profit and loss statements, balance sheets, and cash flow statements, to provide insights into the company’s financial performance. Budgeting Support: Assist in the preparation and monitoring of budgets, track expenses against budgeted amounts, and provide recommendations for cost-saving measures. Tax Compliance: Ensure compliance with US tax regulations, including timely filing of sales tax returns, 1099 reporting, and providing necessary documentation for annual tax preparation. Communication: Maintain open and clear communication with the client to address any financial concerns, provide updates on bookkeeping tasks, and respond promptly to inquiries. Data Security:Bookeeping Job Maintain strict confidentiality of financial information and adhere to data security protocols to protect sensitive financial data. Qualifications and Skills: Proficiency in QuickBooks Online: Demonstrated experience in using QuickBooks Online for bookkeeping and financial management tasks. US Accounting Knowledge: In-depth understanding of US accounting principles,Bookeeping Job including GAAP (Generally Accepted Accounting Principles) and familiarity with tax regulations and compliance requirements. Bookkeeping Experience: Proven track record of at least [specify years] of experience in bookkeeping roles, preferably in a similar capacity. Attention to Detail: Strong attention to detail and accuracy in financial record-keeping to ensure error-free accounting.Bookeeping Job Time Management: Ability to effectively manage time and prioritize tasks to meet deadlines in a fast-paced environment. Communication Skills: Excellent written and verbal communication skills to interact with clients, vendors, and team members effectively. Problem-Solving Abilities: Capacity to identify and resolve accounting discrepancies or issues promptly and independently. Reliable Internet Connection: Stable internet connection and access to necessary software and tools for remote work. Deliverables: Accurate and up-to-date financial records maintained in QuickBooks Online. Timely payment of vendor bills and management of accounts payable. Monthly financial reports provided to the client. Compliance with US tax regulations and timely filing of necessary returns. Regular communication and updates on bookkeeping tasks and financial matters. Timeline: The bookkeeper will work approximately 20 hours per week on an ongoing basis, with specific days and hours to be mutually agreed upon between the client and freelancer. Budget: The budget for this position will be based on the freelancer’s experience, qualifications, and proposed hourly rate. Additional Notes: The freelancer should be available for regular communication meetings with the client to discuss financial matters and provide updates. Any relevant certifications or additional qualifications will be considered advantageous. Confidentiality of all financial information is of utmost importance and must be maintained at all times