Senior Accountant W3Global Inc Ronkonkoma, NY, USA

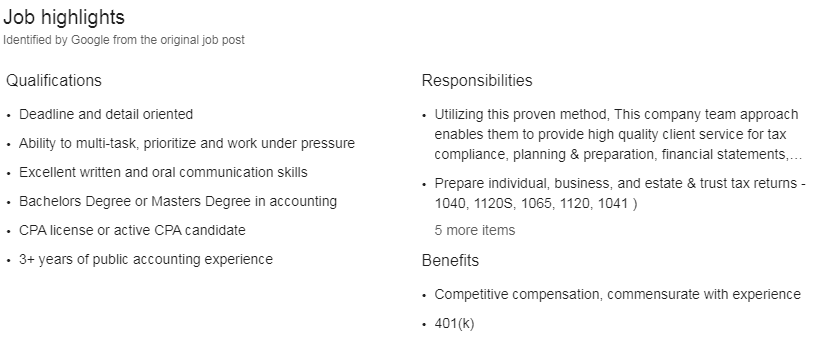

| Qualifications•Deadline and detail oriented•Ability to multi-task, prioritize and work under pressure•Excellent written and oral communication skills•Bachelors Degree or Masters Degree in accounting•CPA license or active CPA candidate•3+ years of public accounting experience |

Accountant

Responsibilities

•

Utilizing this proven method, This company team approach enables them to provide high quality client service for tax compliance, planning & preparation, financial statements, and general business consulting

•

Prepare individual, business, and estate & trust tax returns – 1040, 1120S, 1065, 1120, 1041 )

•

Maintain business client relationships

•

Preparation or review internal client write-ups and closings – monthly, quarterly, and/or annual

•

Prepare or review year end 1099’s, 1098’s, W-2’s

•

Prepare or payroll and sales tax returns

•

Assistance with training less experienced staff

Benefits

•

Competitive compensation, commensurate with experience

•

401(k)

•

Health Insurance

•

Work/life balance including Summer Fridays off – Paid Time Off Exceeds Industry Standards

•

Rewarding careers with supportive management

•

A culture of respect and kindness

•

Professional development

•

Opportunity for firm advancement and career growth

Job description

Accountant This company, PC is seeking a professional, hard-working individual to join their fast-growing team. This company demands independence, integrity, objectivity, competence and due care from all of its personnel. Our firm is uniquely structured to provide leadership in achieving high quality professional performance while maintaining the concept of individual responsibility All levels of our staff enjoy a fun, hands on, fast paced and technically challenging environment, which is specifically catered to, and evolves with, their continuing on-the-job training and expertise. Our firm utilizes the latest and greatest technology and values a progressive outlook on providing premier tax and accounting services to our clients. Utilizing this proven method, This company team approach enables them to provide high quality client service for tax compliance, planning & preparation, financial statements, and general business consulting. Job Description Responsibilities: • Prepare individual, business, and estate & trust tax returns – 1040, 1120S, 1065, 1120, 1041 ) • Maintain business client relationships • Preparation or review internal client write-ups and closings – monthly, quarterly, and/or annual • Prepare or review year end 1099’s, 1098’s, W-2’s • Prepare or payroll and sales tax returns • Assistance with training less experienced staff Skills / Qualifications / Experience: • Deadline and detail oriented • Ability to multi-task, prioritize and work under pressure • Excellent written and oral communication skills • Bachelors Degree or Masters Degree in accounting •Accountant CPA license or active CPA candidate • 3+ years of public accounting experience Software Knowledge – Preferred but not mandatory: • Microsoft Office products (Word, Excel, Outlook, Teams) • ProSystem Fx Software Suite, including: Engagement and Workstream • QuickBooks Desktop and Online • CCH Tax Access • TeamViewer, Zoom, and/or other remote access technology At This company you will have: • Competitive compensation, commensurate with experience • 401(k) • Health Insurance • Work/life balance including Summer Fridays off – Paid Time Off Exceeds Industry Standards • Rewarding careers with supportive management • A culture of respect and kindness • Professional development • Opportunity for firm advancement and career growth • Remote working capabilities • Use of top-of-the-line equipment, technology, and software Accountant